ETF portfolio objectives

our ETF portfolios are graded across the risk spectrum, and provide a fully diversified, cost-effective and completely transparent solution for your core portfolio. All of our sustainable ETF portfolios offer daily liquidity, meaning that investors can buy or sell any day, with no lock-in or penalty

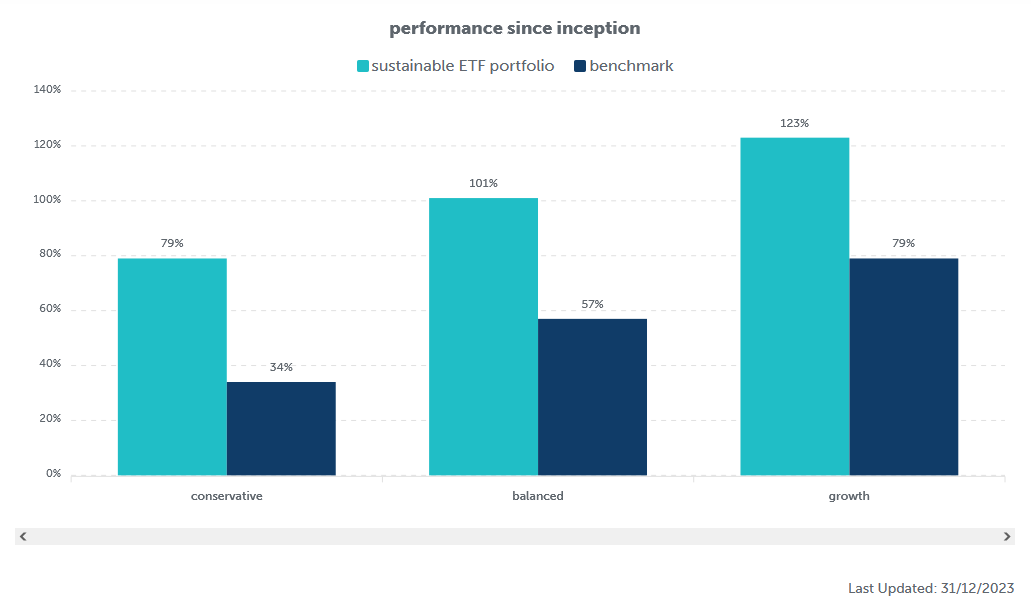

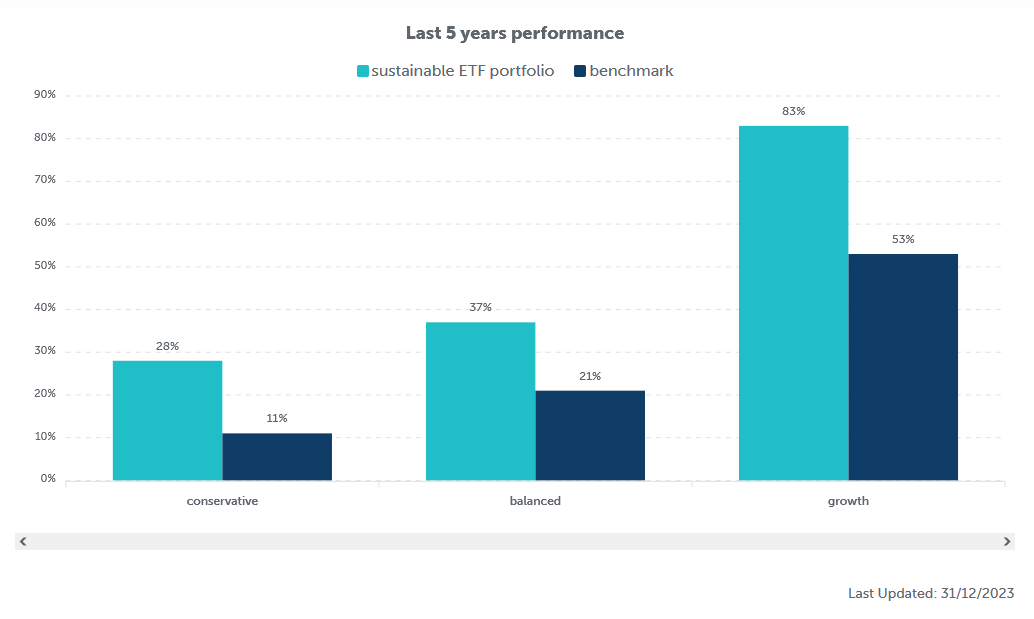

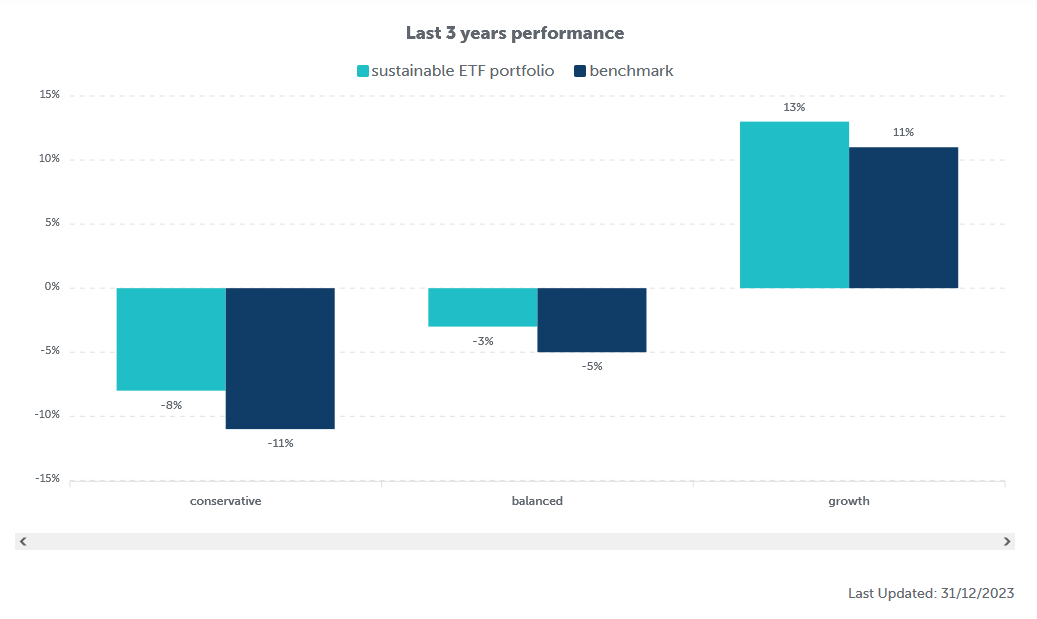

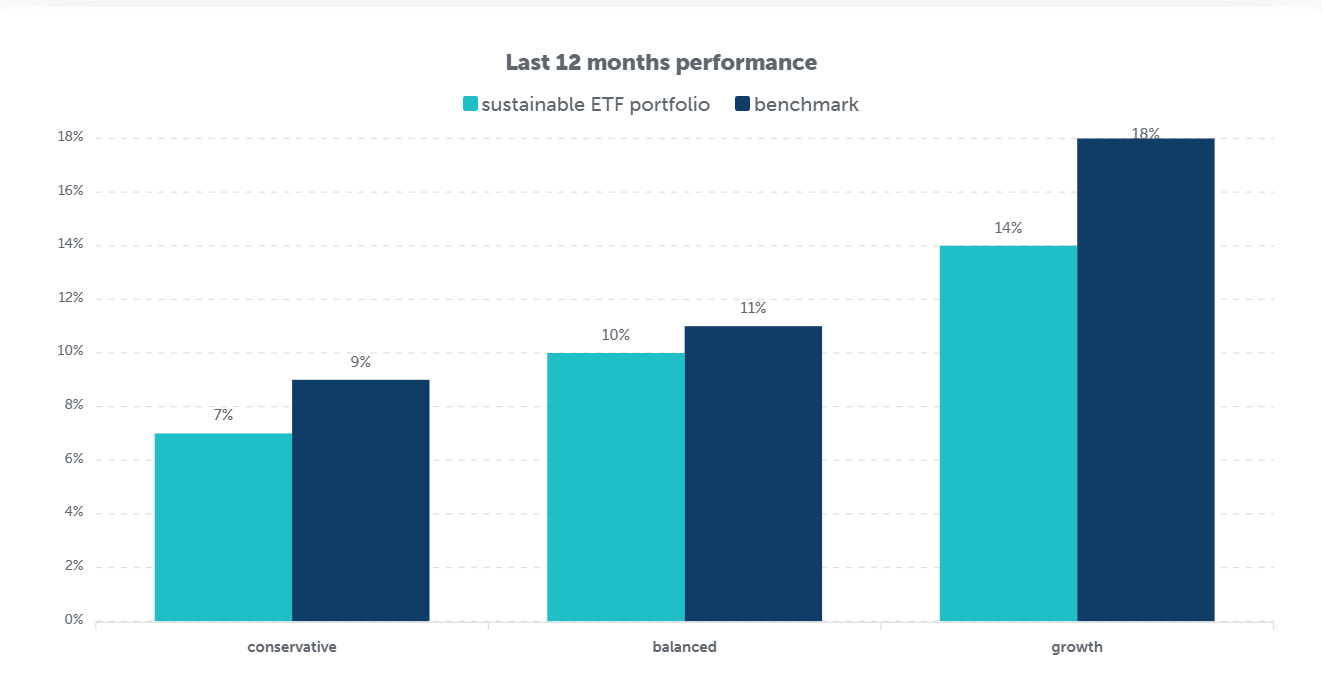

we use a selection of technical trading signals for our ETF selection. Over the last 15 years, we have consistently generated outstanding performance. We have significantly outperformed the benchmark in each of our sustainable ETF portfolios.

The average annual outperformance for each of the three strategies is +3.71% (as of August 2024)

- Performance Since Inception

- Last 5 years Performance

- Last 3 years Performance

- Last 12 months Performance

- Benchmark

Composition

-

-

-

-

-

bonds equities commodities property conservative 60% 30% 5% 5% balanced 40% 40% 8% 10% growth 0% 90% 0% 0%

WHAT are the advantages of our ETF portfolios?

-

Low cost

Offering much better value than traditional funds, ETFs typically cost investors 0.1% – 0.2% per annum. Using these ETFs, we construct ready-made sustainable portfolios for investors of all types

-

Liquidity

ETFs are highly liquid, meaning there are high trading volumes and they can be bought and sold even in times of market turbulence. All our portfolios offer 24-hour encashment to investors

-

Diversification

ETFs can reduce the overall volatility of your portfolio through diversification. Our sustainable ETF portfolios are all globally diversified amongst the major asset classes (equities, bonds, commodities etc.).

-

Transparency

ETFs are completely transparent. Data for their holdings, their performance and their costs are updated daily. This means you can always see exactly what you own in your ETF portfolio

HOW to invest in our ETF portfolios?

-

Within a managed account

the client (be it a person, corporation or trust) has full control and ownership of their account at all times. Managed accounts offer the ability to withdraw up to 70% of the account value as a cash loan, at highly competitive interest rates. Managed accounts are available with InteractiveBrokers or Swissquote .

how do we choose the ETFs in our sustainable portfolios?

our investment process ensures we only use the most transparent, liquid and cost-effective ETFs. We only use replication ETFs. We do not use any synthetic, leveraged or inverse ETFs. we exclude all non-compliant investments (oil, heavy polluters, weapons, etc.) and actively include sustainable ETFs (solar, water, gender equality, etc.).

Liquidity

Most of the ETFs we deploy in our portfolios have market capitalisations in the USD billions, making them some of the most liquid investments available anywhere. We only use ETFs that have a market capitalisation of at least USD 100 million, and daily US dollar liquidity of at least 10 million

Cost

we actively monitor the costs of all the ETFs in our investment universe (numbering over 1000 ETFs currently). All else being equal, we will always choose the lowest-cost ETF, considering the TER (Total Expense Ratio) and bid-offer spread

Our investment approach

Our investment process combines asset selection, based primarily on technical criteria, with quantitative risk management within clearly-defined volatility constraints

We invest according to a range (typically 12-15) of technical trading signals. No investment decision will be executed unless the technicals suggest the timing is correct. We have a core / satellite structure, where each component is actively managed

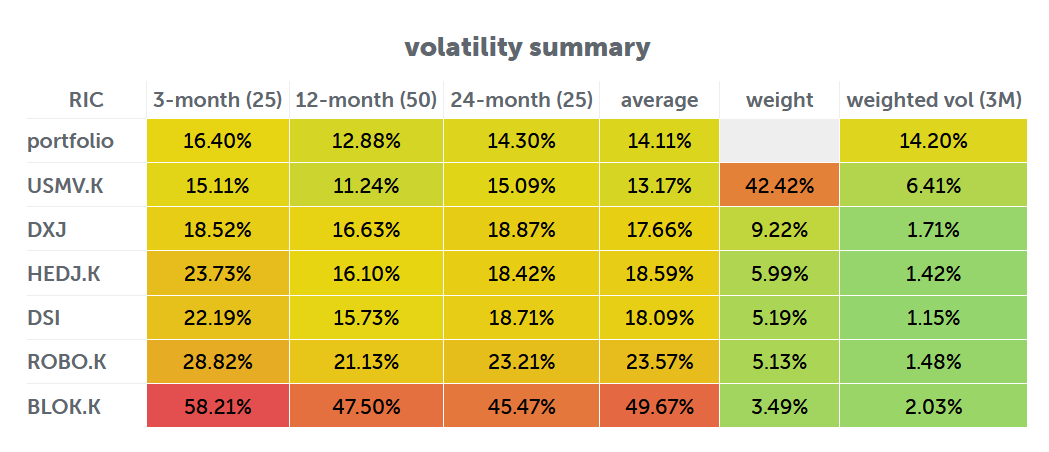

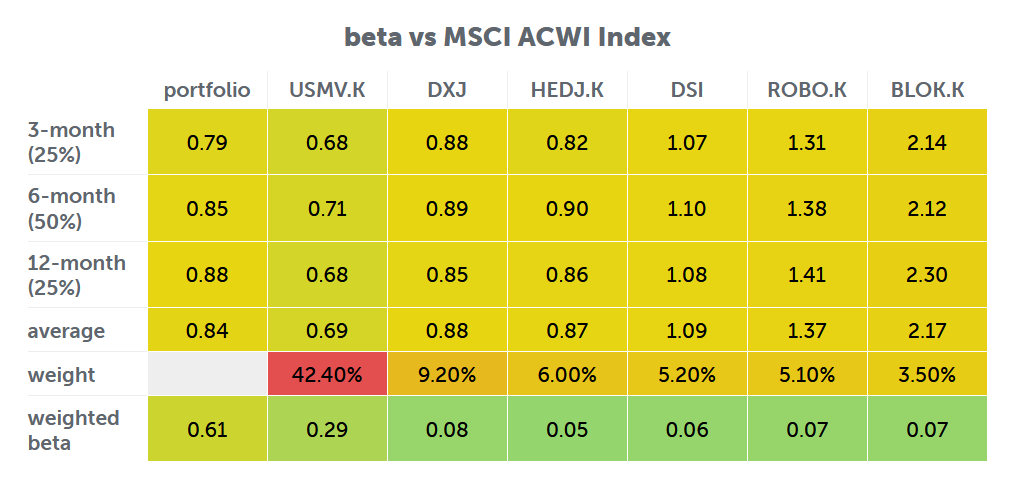

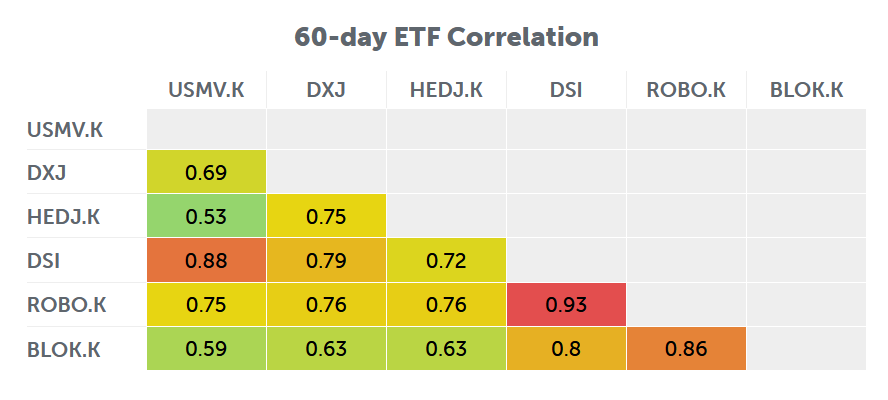

Examples of basic risk controls are shown below:

- Volatility Summary

- beta vs MSCI ACWI Index

- 60-day ETF Correlation

Our range of ETF portfolios

Explore our different approaches to sustainable investing and evaluate our specific portfolios

- Sustainable GROWTH portfolio objectives

- Sustainable BALANCED portfolio objectives

- Sustainable CONSERVATIVE portfolio objectives

-

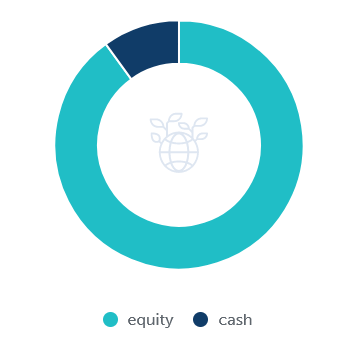

Our sustainable growth ETF portfolio is a globally-diversified portfolio made up exclusively of equity ETFs

Why choose our growth ETF portfolio?

- For investors seeking 100% equity exposure and with a high risk tolerance.

- Targets long-term capital gains whilst preserving the planet.

-

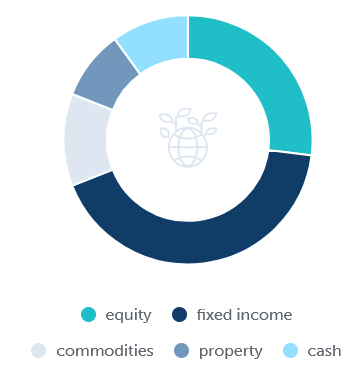

Our sustainable balanced ETF portfolio is a globally-diversified portfolio made up of broadly equal weightings in bond and equity ETFs. We may also invest in some precious metal and property ETFs

Why choose our sustainable balanced ETF portfolio?

- For investors seeking a medium-risk, diversified portfolio, and open to moderate exposure to equities (maximum 60%).

- Protects from the worst impact of equity market sell-offs.

-

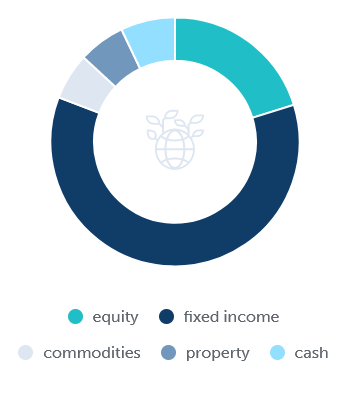

Our sustainable conservative ETF portfolio is a globally-diversified portfolio made up mostly of bond ETFs, and a maximum of 40% in equities. We may also invest in some precious metal and property ETFs

Why choose our sustainable conservative ETF portfolio?

- For investors seeking a low-risk, diversified portfolio and prioritising capital preservation, but open to a modest exposure to equities.

- A basis for collateralised loans against your portfolio (up to 70% possible).